P. O. Box: 565

Barka Sultanate of Oman

Services we provide

Registering a Company in Oman

Embarking on the establishment of a corporate entity in Oman demands a judicious understanding of the meticulous process of company registration. The Sultanate, with its robust economy and strategic positioning, presents an enticing milieu for business ventures.

Commencing the process of registering a company in Oman requires meticulous adherence to the regulatory guidelines set forth by the Ministry of Commerce, Industry, and Investment Promotion. A variety of business structures, ranging from Limited Liability Companies (LLCs) to Joint Stock Companies, necessitate a thoughtful selection process, considering operational intricacies and foreign ownership constraints.

Pricing

Company registration costs in Oman

In this section, we will review the details of company registration costs in Oman. All the costs that you will face in this way are listed below.

OMR 1500

Per Month

- From Oman Residency

- Special transfer

- Advice on company registration and residence

- Registration of all types of companies from grade 4 to premium

- Submission of registered company documents

- Company registration in less than 48 hours

- Obtaining an activity permit (permit)

- Obtaining a 2-year work visa

- Receive a 2-year residence card

- Opening a personal and corporate bank account

OMR 1100

Per Month

- From Oman Work Permit

- Advice on company registration and residence

- Registration of all types of companies from grade 4 to premium

- Submission of registered company documents

- Register in less than 48 working hours

- Obtaining an activity permit (permit)

- Obtaining a 2-year work visa

OMR200

Per Month

- From Company Registration

- Initial consultation

- Registration of all types of companies from grade 4 to premium

- Submission of registered company documents

- Register in less than 48 working hours

Company registration procedures in Oman

Registering a company in Oman involves selecting a business structure, preparing a business plan, and submitting documents to the Ministry for approval. Upon approval, receive the Commercial Registration Certificate, officially recognizing the business. Ongoing compliance with regulations is essential. This brief overview guides through the steps of company registration in Oman.

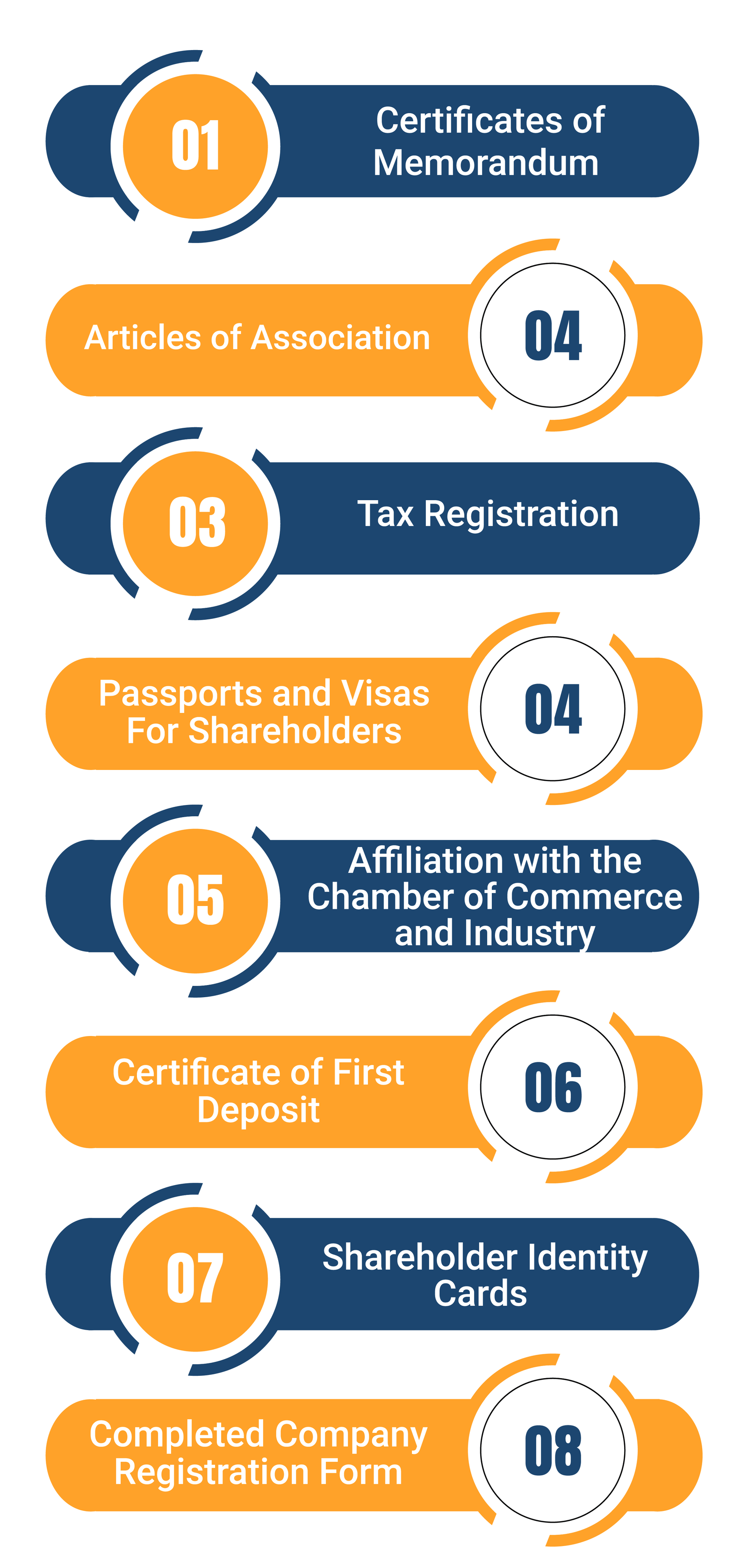

Details of company registration procedures in Oman

1. Choose Your Business Structure

Oman offers diverse business structures, including Limited Liability Company (LLC) for up to 70% foreign ownership, Joint Stock Company for larger enterprises, Sole Proprietorship for Omani nationals, and options for foreign companies like branches or representative offices.

2. Select a Business Activity

Clearly define the nature of your business activities. Oman’s business classification system categorizes activities into various sectors. Your chosen business activity will determine the necessary permits and approvals from relevant authorities.

3. Reserve Your Company Name

Choosing a unique and appropriate company name is crucial. The proposed name must be approved by the Ministry of Commerce and Industry (MOCI). It’s advisable to have a few alternative names in case your primary choice is already registered.

4. Share Capital and Ownership

Determine the share capital for your company. The minimum share capital varies based on the business structure and activity. The shareholding structure must also be defined, specifying the percentage of ownership for each shareholder.

5. Prepare Legal Documents

Prepare the necessary legal documents, including the company’s Memorandum of Association (MOA) and Articles of Association (AOA). These documents outline the company’s objectives, structure, and internal regulations. They must be notarized and submitted to the MOCI.

6. Register with the Commercial Registry

Register your company with the Commercial Registry at the MOCI. This step involves submitting the required documents and paying the registration fees.

7. Obtain a Commercial License

After successful registration, you will receive a commercial license that allows you to conduct your business activities in Oman. The license will specify the nature of your business and any relevant restrictions.

8. Register for Taxation

Register your company with the tax authorities and obtain a tax identification number. Oman has a relatively straightforward tax system, and understanding your tax obligations is essential.

Benefits of company registration in Oman

Certainly! Here are some potential benefits of company registration in Oman:

Strategic Location

Oman’s strategic location at the crossroads of the Arabian Peninsula makes it an ideal hub for business activities. Its proximity to key markets in the Middle East, Africa, and Asia provides companies with easy access to a diverse range of markets.

Liberal Business Laws

Oman has implemented business-friendly laws and regulations to encourage foreign investment. The legal framework is designed to protect the rights of investors and provide a transparent and efficient system for company registration and operation.

Investment Incentives

The Omani government offers various investment incentives to attract foreign investors. These incentives may include tax breaks, reduced import duties, and other financial advantages that can significantly contribute to the profitability of registered companies.

Free Trade Agreements

Oman has entered into various free trade agreements (FTAs) with countries around the world. These agreements facilitate international trade and provide registered companies with preferential access to a broad range of markets.

Quality of Life

Oman offers a high quality of life, with a stable political environment, modern amenities, and a rich cultural heritage. This makes it an attractive destination for expatriates and can be a valuable factor in attracting and retaining skilled employees.

Infrastructure Development

The government of Oman has heavily invested in infrastructure development, including transportation, communication, and logistics. This focus on infrastructure ensures that businesses can operate efficiently and effectively within the country.

Taxation System

Oman has a favorable tax regime for businesses. While the specifics may vary, the overall taxation system is designed to attract foreign investment and encourage entrepreneurship.

Stable Economic

Oman has maintained a stable economic environment, with a commitment to economic diversification and development. The government’s initiatives to boost non-oil sectors contribute to a resilient and growing economy, providing a favorable backdrop for businesses.

Types of Company Registration in Oman

Before diving into the vibrant Omani market, it is essential to understand the various types of company registration available. The Sultanate of Oman offers several structures for business entities, each catering to different business needs and objectives.

Limited Liability Company (LLC):

- The Limited Liability Company is the most common and widely used business structure in Oman. It is suitable for small to medium-sized enterprises.

- The key feature of an LLC is that the liability of each shareholder is limited to their share capital, providing a degree of protection for personal assets.

- An LLC in Oman must have a minimum of two and a maximum of 40 shareholders.

Joint Stock Company (SAOG/SAOC):

- A Joint Stock Company is appropriate for larger businesses and those planning to go public in the future. It can be either a Joint Stock Company SAOG (Public Joint Stock Company) or SAOC (Closed Joint Stock Company).

- SAOGs can offer their shares to the public through an initial public offering (IPO), while SAOCs have a restricted number of shareholders.

- The minimum capital requirements for SAOGs are typically higher compared to LLCs.

Branch of a Foreign Company:

- Foreign companies can establish a presence in Oman by registering a branch. This structure allows a foreign company to conduct business in Oman without the need to establish a separate legal entity.

- The branch is subject to Omani laws and regulations, and a local agent is required to facilitate the registration process.

Representative Office:

- A Representative Office is suitable for foreign companies seeking a non-trading presence in Oman. It allows companies to engage in market research, promotion, and other non-commercial activities.

- Representative Offices are not permitted to engage in profit-generating activities and are subject to certain restrictions.

Single Person Company (SPC):

- Introduced to promote entrepreneurship, the Single Person Company structure allows a single individual to establish and run a business with limited liability.

- The owner is responsible for the company’s debts and liabilities up to the amount of the company’s share capital.

Limited Partnership:

- Limited Partnerships consist of one or more general partners with unlimited liability and one or more limited partners with liability limited to their capital contributions.

- This structure is commonly used in businesses where certain partners want to invest capital without being directly involved in management.

Simple Commandite:

- A Simple Commandite is a type of partnership where one or more partners have unlimited liability (general partners) and one or more partners have limited liability (limited partners).

- General partners are actively involved in management, while limited partners contribute capital without participating in day-to-day operations.

Below we look at the types of companies in Oman

// Company formation in Oman

Understanding Limited Liability Company (LLC) Formation in Oman

A Limited Liability Company (LLC) in Oman is a popular and flexible business structure that combines elements of partnership and corporate structures. Among the various business structures available, the Limited Liability Company (LLC) is a popular choice due to its flexibility and protection of personal assets. Here, we delve into the key aspects of LLC company formation in Oman.

Limited Liability:

One of the primary attractions of forming an LLC in Oman is the limited liability it offers to its shareholders. The personal assets of individual shareholders are protected, and their liability is restricted to the amount.

Commercial Registration:

The Ministry of Commerce and Industry oversees the registration of LLCs in Oman. Once the required documents, including the MOA, AOA, and evidence of capital deposit.

Shareholder Requirements:

An LLC in Oman can have a minimum of two and a maximum of 40 shareholders. This flexibility makes it suitable for both small businesses and those with larger ownership structures.

Capital Requirements:

Shareholders are required to contribute a minimum share capital to establish an LLC in Oman. The deposited capital is an essential element in obtaining final approval for the company's registration.

Business Licensing:

While the commercial registration allows the LLC to operate as a legal entity, additional licenses may be required based on the nature of the business.

Memorandum of Association and Articles of Association:

The MOA and AOA are foundational documents that define the structure, objectives, and internal regulations.

Publication:

Details of the newly formed LLC, including its name, capital, and other relevant information, are published in the Official Gazette, providing public notice of the company's existence.

Taxation:

Oman has a straightforward tax system. LLCs are subject to income tax on their profits. The tax implications and compliance requirements is crucial for LLCs operating in Oman.

Types of Business Licenses in Oman

In Oman, business licensing is an essential step for entrepreneurs looking to establish and operate a business. Here are some common types of business licenses in Oman:

Commercial Registration (CR)

The Commercial Registration is a fundamental license that every business operating in Oman must obtain. It is issued by the Ministry of Commerce and Industry. This license provides basic information about the business, such as its name, location, nature of activities, and ownership details.

Professional License

Professionals such as doctors, engineers, consultants, and other service providers typically require a Professional License. This license is issued by the relevant professional regulatory authority and may have specific requirements related to education, experience, and professional qualifications.

Industrial License

Businesses involved in manufacturing or industrial activities need to obtain an Industrial License. The issuance of this license is often subject to compliance with environmental and safety standards. It is granted by the Ministry of Commerce and Industry.

Tourism License

Businesses operating in the tourism sector, such as travel agencies, tour operators, and hotels, require a Tourism License. This license is issued by the Ministry of Tourism and may have specific criteria related to facilities, services, and quality standards.

Import/Export License

For businesses engaged in importing and exporting goods, an Import/Export License is necessary. This license is usually issued by the Directorate General of Customs, and it ensures that businesses comply with customs regulations and trade laws.

Food Handling License

Restaurants, cafes, and food-related businesses need a Food Handling License. This license is typically issued by the Ministry of Regional Municipalities and Water Resources and ensures compliance with health and safety standards.

Telecommunications License

Businesses operating in the telecommunications sector require a Telecommunications License. The Telecommunications Regulatory Authority (TRA) is responsible for issuing licenses in this sector.

Financial Services License

Companies providing financial services such as banking, insurance, or investment services need to obtain a license from the Capital Market Authority (CMA) or the Central Bank of Oman, depending on the nature of the financial activity.